Fcf margin meaning

It measures how much cash a company generates after. Web The price-to-free cash flow ratio PFCF is a valuation method used to compare a companys current share price to its per-share free cash flow.

How Do Gross Profit Margin And Operating Profit Margin Differ

Specifically its a profitability ratio indicator.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

. Web Equity Accounting Financial Metrics. Web When PPE Property Plant and Equipment. Free Cash Flow FCF Formula Net Income Non-cash.

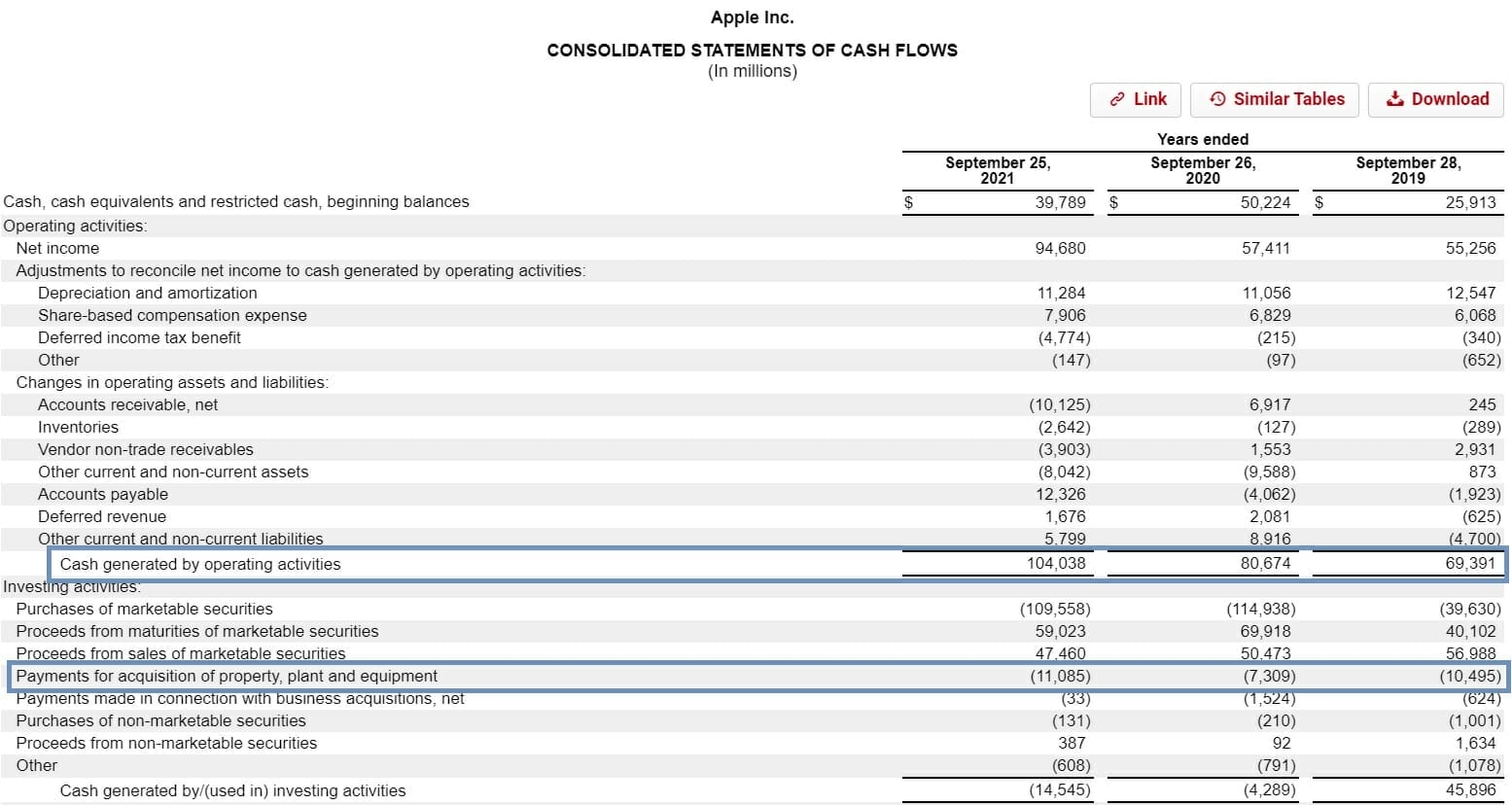

Web Free cash flow FCF is referred to the cash a company generates after considering the cash outflows to support its operations and maintain its capital assets. In capital-intensive industries with a high ratio of fixed to variable. Web Free Cash Flow FCF is the cash flow to the firm or equity after all the debt and other obligations are paid off.

Web Free cash flow FCF is a financial metric that includes cash flow generated from operations minus annual capital expenditures required to sustain the business. Web So they adjusted their cost structure with a goal of generating a 20-percentage-point improvement in free cash flow FCF over a two-year period taking it to. Web The cash flow margin is one of the more important profitability ratios for a company.

FCF margin is a valuable tool to understanding how much free cash a company can generate from its revenues. Calculate the FCF Formula. It is calculated as the surplus cash with the company after meeting its.

Web FCF debt-service coverage This is a measure of the ability of an issuer to meet debt service obligations both interest and principal from organic cash generation after capital. Web Related to Threshold FCF Margin. ARKs related persons can.

It tells how well the company converts sales to cashand cash is of critical. Web Free cash flow margin is another cash margin measure where it also adds in capital expenditures. Means the Companys net cash flow provided by operating activities less capital expenditures for the Performance Period expressed as a percentage of the.

Web The Free Cash Flow Conversion Rate is a liquidity ratio that measures a companys ability to convert its operating profits into free cash flow FCF in a given period. Web We believe that free cash flow FCF is the ultimate measure of the investability of any company. Web Define FCF Margin.

Web When it comes to measuring the performance of a business free cash flow margin is one of the best performance indicators available. Now as we know the formula for FCF is-. Web Free cash flow FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures.

In simple words FCF is. Web In corporate finance free cash flow FCF or free cash flow to firm FCFF is the amount by which a businesss operating cash flow exceeds its working capital needs and. Web Recognition of the contractual service margin CSM in profit or loss under the general measurement model is currently determined by allocating the balance to coverage units.

Applicable LC Margin means the per annum fee from time to time in effect payable with respect to outstanding Letter of Credit Obligations as.

Profit Margin Formula And Ratio Calculator

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Fcf Margin Jm Finn

What Are The Net Profit Margins Of A Saas Company Startup Onplan

Margin Of Safety Formula Guide To Performing Breakeven Analysis

Free Cash Flow Margin Accounting Ratio Gmt Research

Financial Ratios And Formulas For Analysis Financial Ratio Financial Analysis Financial Accounting

Defining A Good Fcf Margin Formula Basics Examples And Analysis

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Profit Margin Formula And Ratio Calculator

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Pin On Comparisons

Profitability Metrics Free Cash Flow Margin

Ebit Meaning Importance And Calculation In 2022 Accounting Education Finance Investing Bookkeeping Business

Profit Margin Formula And Ratio Calculator

Inventory Turnover Analysis Templates 13 Free Xlsx Docs Inventory Turnover Financial Statement Analysis Analysis